Income protection insurance for contractors

Working for yourself can come with freedom and flexibility, but it also means you carry the full weight of your income. Without employer-funded sick leave entitlements, it's just you, your work, and your ability to keep the business going.

So what happens if you suddenly cannot work? An unexpected sickness or injury could leave you unable to earn an income. That's where income protection insurance comes in. It's more than just a policy: it can be a financial safety net that helps protect your income if life takes an unforeseen turn.

In this guide, we'll unpack everything you need to know about income protection insurance as a contractor or self-employed individual, including how it works, what it covers, and why it matters.

What is income protection insurance?

Income protection insurance is designed to pay a portion of your regular income if you're unable to work due to sickness or injury. It's usually paid monthly over a set period of time (known as the benefit period), and it helps replace a portion of your earnings while you recover.

Many income protection insurance policies pay up to 70% of your monthly pre-tax income if you cannot work because of sickness or injury. This can help cover essential living expenses, business costs, and everyday bills.

For contractors, freelancers, or sole traders who don't have access to employee entitlements like sick leave or annual leave, income protection can be a vital safety net.

Can contractors get income protection insurance?

Yes, contractors, freelancers, small business owners, and other self-employed people can take out income protection insurance. In fact, income protection insurance for self-employed individuals could be important because many don't have the same financial safety nets as other full-time employees.

How much income protection insurance can you get?

The amount income protection insurance pays depends on a few key factors – mainly your income, the policy terms, and how the insurer assesses your application. Most policies offer a monthly benefit of up to 70% of your pre-tax income, but the exact amount can vary based on your:

- Job

- Age and medical history

- Income (usually based on the past 12 months)

- Working hours

- Chosen waiting period and benefit period

- Lifestyle factors (like smoking or high-risk activities)

For example, with Real Income Protection Insurance, you could be covered for up to 70% of your pre-tax income – up to $15,000 per month.

But how do insurers assess your income if you’re self-employed? As a contractor, your pre-tax income is calculated based on your total share of income earning in the business as a direct result of your personal efforts, minus any business expenses and superannuation contributions.

For example, if your personal income is $5,000 per month as someone who is self-employed and are injured and unable to work for several months, you could be eligible to receive up to $3,500 per month, depending on your policy and circumstances.

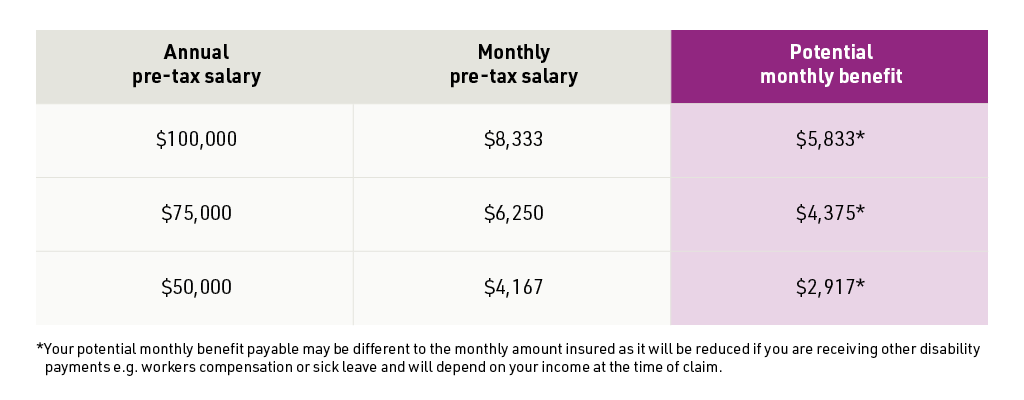

But what does that actually look like in practice? The table below shows how different income levels translate into potential monthly benefit payments:

A benefit of income protection insurance for contractors

If you're self-employed, being unable to work can take a serious toll – both financially and emotionally. That’s why income protection insurance isn’t just a "nice-to-have". It can be the difference between staying afloat during tough times or having to put your business on hold.

Here are some of the key benefits of income protection insurance for contractors:

Covers income loss due to sickness or injury

Unlike employees, self-employed people don’t typically have paid sick leave to fall back on. Income protection insurance pays a monthly benefit when you can't work due to sickness or injury, allowing you to keep up with everyday costs, such as rent or mortgage repayments, utility bills, and groceries.

Find out more about what income protection insurance covers.

No cover under workers’ compensation

If you’re classified as a contractor, you may not be eligible for workers’ compensation in the same way employees are. With an income protection insurance policy in place, you don’t need to solely rely on dipping into your personal savings if an injury or sickness prevents you from working.

Supports part-time and temporary workers

Income protection insurance can be flexible enough to suit different types of work, including part-time, temporary, or project-based jobs. If your income varies or you work seasonally, you can often still get coverage – as long as you meet the insurer’s criteria.

For example, One eligibility criterion for Real Income Protection Insurance is that you must be working a minimum of 15 hours per week.

This means you could receive support even if you’re not working full-time or have multiple sources of income. You’ll typically need to show proof of your average earnings over a set period, like the past 12 months, to determine your benefit amount.

Provides global coverage

Some income protection insurance policies even offer cover no matter where you are in the world. So, if you’re travelling or living overseas when you get sick or injured, you may still be able to make a claim and receive payments – as long as you meet the policy conditions. It is important to check the Policy Disclosure Statement (PDS) to understand what these conditions are.

For example, provided you are an Australian citizen or permanent resident living in Australia at the time of application, and if you meet the remaining criteria, you may receive cover anywhere in the world by Real Income Protection Insurance.

This is especially useful for digital nomads, travelling professionals, or contractors who take on international work. Some policies may require that treatment is received in Australia or that you return home within a certain time frame to continue receiving payments. If this is something you need, make sure to read the fine print (also known as the insurer’s Product Disclosure Statement) or ask about global cover before committing to a policy.

Key policy terms to understand

If you’re new to income protection, some of the terminology can be confusing. Here are a few crucial terms to be aware of before you purchase a policy:

- Waiting period: This is how long you’ll need to wait after becoming unable to work before your payments begin – usually 30, or 90 days.

- Benefit period: The maximum amount of time you can receive payments while you're off work. This could be 2 or 5 years, or right up to a certain age (like 65).

- Monthly benefit: The amount you'll receive each month if you make a successful claim. This is generally calculated as a percentage of your regular pre-tax income.

- Indemnity vs. agreed value: Indemnity value policies base your payments on your income at the time you make a claim, while agreed value policies lock in your benefit amount when you take out the cover.

- Exclusions and limits: Every policy has rules about what’s covered and what isn’t. Always read the Product Disclosure Statement (PDS) to understand exclusions, like pre-existing conditions or certain high-risk activities.

Income protection insurance tax benefits

One of the potential advantages of income protection insurance – especially if you're self-employed – is that your premiums may be tax-deductible. In some cases, you can claim the cost of your premiums on your tax return, as long as the policy is held outside of super and is specifically set up to replace your income (not to provide a lump sum or cover things like life insurance).

Keep in mind that any benefit payments you receive will generally be assessable as taxable income. That means you’ll need to include these payments in your tax return. Always speak to a qualified accountant or tax professional to understand exactly how these deductions apply to your situation and what records you’ll need to maintain.

Keep Reading: Discover the ins and outs of income protection insurance.

Income protection insurance for contractors FAQsFrequently Asked Questions

How are income protection insurance premiums calculated for a contractor?

Your income protection insurance premium is based on several factors that help insurers assess your level of risk. These can include:

- Your age and gender

- The type of work you do and how risky it is

- Your health and medical history

- Whether or not you smoke

- The benefit period and waiting period you choose

- Your income and how your business is structured

If you're self-employed, insurers may also take a closer look at your business’s cash flow and expenses. You’ll usually need to provide financial records like tax returns and profit-and-loss statements. The more clearly you can show your income, the easier it is for the insurer to set a fair benefit amount.

What is considered income for a contractor?

For self-employed people, income is generally calculated as your earnings after business expenses have been deducted. If you work under a company or trust, it might also include your salary and any dividends you take from the business.

Most insurers will look at your income – usually from over the last 12 months – to figure out your average monthly earnings. That’s why keeping accurate, up-to-date records can be important.

Since each insurer may calculate income slightly differently, it’s always a good idea to read the policy’s PDS. This will help you understand exactly how your income is assessed and how your benefit amount would be worked out if you need to claim.

As a contractor, your income often depends on staying healthy, meeting deadlines, and keeping the work flowing. But if an unexpected sickness or injury takes you out of action, that’s where income protection can make a real difference. It provides a safety net to help you stay on top of your finances while you focus on your recovery.

If you're thinking about taking out cover, consider Real Income Protection Insurance. It's designed to give you the support you need as a contractor or self-employed person, with flexible options to suit your type of work and income. Request a quote online today and take a proactive step towards protecting your livelihood — just in case life ever takes an unexpected turn.

5 May 2025

Zoe Ng

Content writer, foodie, crazy cat lady.

With over a decade of experience in Copywriting and Publishing, Zoe has crafted copy and content for brands like AirAsia and leading titles such as Harper’s Bazaar and Women’s Health Malaysia.