Real Insurance, Real Easy

We are pleased to offer our customers flexible payment options for our Comprehensive Car Insurance cover.

And, in the event that you need to make a claim, our claims lodgement and emergency assistance centre are happy to help. Our claims team is available 24 hours a day, seven days a week on 13 19 48.

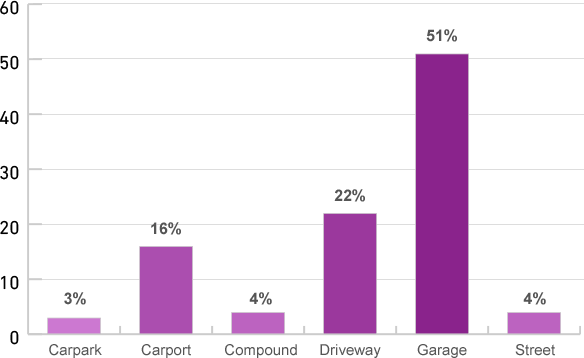

Where customers park their car at night

Get the peace of mind of around the clock cover with Real Comprehensive Car Insurance.

Whether you’re like the 51% of our customers that park their car in a garage overnight, or like the 49% of our customers that park elsewhere2, you can rest assured knowing our Comprehensive Car Insurance covers you while you’re sleeping.

17 years of award-winning insurance

At Real Insurance we pride ourselves on providing trusted service and real value to our customers, which has been recognised by 17 consecutive years of industry awards.

Get Comprehensive Car Insurance for the unpredictable – rain, hail, or shine!

Other Commonly Asked Questions

Do you offer cover notes?

No, we do not offer cover notes for car insurance cover.

Do you have age restrictions on your car insurance?

We insure licenced drivers and learner drivers. We do not cover drivers that are younger than any age restriction shown on your Certificate of Insurance as certain vehicles have higher age minimums. We will not cover drivers under 25 if you have selected to exclude drivers under 25 years old for your policy.

How do I make changes to my car insurance policy?

You can make changes to your car insurance policy quickly and easily by calling us on 13 19 48. It only takes a few minutes, and there are no administration fees. Remember, depending on the changes you make, the cost of your car insurance premium could change too.

You can also use our online Car Insurance Account to:

- Access your policies.

- View your Certificates of Insurance.

- Update your contact details and payment information.

I’ve had a car accident. What should I do?

Step 1

Make sure you and your family are safe and your car is secure so it is not damaged further.

Step 2

You will need to get details of anyone else involved i.e. full name, address, phone number, registration number, driver’s licence number and insurer.

Step 3

Report the incident to the police if the law requires it to be reported.

Step 4

Call our claims team 13 19 48, 24 hours a day, seven days a week

If you can’t contact us, do everything you can to prevent any further damage, including having your car towed to the nearest safe place.

Can I choose my own repairer when I make a claim?

Our policies do not offer a choice of repairer. If you need to make a claim and your car needs repairs, we’ll choose a qualified repairer located as close as possible to your home or work from our extensive network. When you use one of our approved or appointed repairers, the repairs are covered by a guarantee.

If you prefer to choose your own repairer, you can arrange for a quote and send it to us although we have the final say on who will do the repairs.

How do I lodge a car insurance claim?

It’s easy to lodge a car insurance claim with Real Insurance. Just call 13 19 48 and our personal Client Manager will help you through the process, step by step. You can also submit a claim online through our online Claims Centre if it’s not an emergency.

What happens if I don’t disclose all my claims or forget to tell you about claims I have had?

You need to disclose previous car insurance claims within the last 3 years for us to determine whether we are able to offer you cover. When you make a claim we may verify your previous claims history. If you do not disclose the correct information, we have a right to cancel your policy and not pay your claim.

What is a car insurance excess?

An excess is the amount you need to contribute towards the cost of repairing your car if you make a claim. To make car insurance premiums more reasonable for everyone, we include an excess in your policy. Then, when you make a claim, you’ll need to pay your excess(es).

There are different types of excesses, which you or the driver of your car at the time of the claim might need to pay. If your claim is for more than one accident or event, you or the driver will have to pay the excess for each accident or event. You can find the amount of excess you’ll need to pay on your Certificate of Insurance.

When will I need to pay an excess?

In the event of a claim and you are required to pay an excess(es), then we will ask you to pay:

- your excess(es) to the repairer when you pick up your car; or

- directly to us when we request it; or

- we may deduct your excess(es) from the amount we agreed to pay you

How does the excess amount affect the premium I pay?

The excess is the amount you contribute towards a claim, therefore, if you are willing to contribute more at the time of a claim (higher excess) you will have a lower premium during the policy period. A lower excess would mean you would pay a higher premium.

Can I change my car insurance excess?

You have the flexibility to increase your excess at any time during your car insurance policy. However, you can only decrease your excess when renewing your policy or during the 14 day cooling off period if you have not made a claim.

What is an ‘agreed value’?

The agreed value of your car is the amount we agree to insure your car for. The agreed value is valid for the term of your car insurance policy. The agreed value for your car is shown on your current Certificate of Insurance. This amount may change with each renewal.

What is ‘market value’?

The reasonable market-related value that we determine the market would pay for your car immediately before its loss or damage. We take into account the age, make, model, conditions and kilometres travelled by your car and may consider industry publications to help determine the amount. The amount does not include any registration costs, stamp duty or transfer fees or allowance for dealer delivery.

Market value includes an allowance for accessories. The market value may be subject to a limit, which if applicable, will be shown on your Certificate of Insurance.

Are there any optional benefits I can add to my car insurance?

Depending on the type of car insurance cover you choose, you can add optional extras, such as Hire Car cover, Excess Free Windscreen cover or Roadside Assistance. Simply choose the extras you’d like when you get a car insurance quote online, take out a policy, or ask our friendly customer service consultants when you call.

Am I covered for windscreen replacement even if I don’t have the extra Excess Free Windscreen option

if your windscreen is damaged we will pay the cost of replacing or repairing the front windscreen. An excess will be applicable.

What is the Pay As You Drive option?

Pay As You Drive is a unique concept in car insurance. Designed specifically for cars that are driven 15,000km per year or less, it offers all the benefits of Comprehensive insurance, but you only pay for the kilometres you plan to drive. Here's a summary of how it works:

When you buy a Pay As You Drive policy, you nominate the number of kilometres you plan to drive each year (up to 15,000km) and tell us your car’s odometer reading at the start of the policy. We add these together to calculate your End Odometer reading, which will be shown on your Certificate of Insurance.

We calculate your premium based in part on the number of kilometres you tell us you plan to drive.

At the time of a claim, if your car's odometer reading at the time of the incident is more than your Start Odometer reading and less than the End Odometer reading shown of your Certificate of Insurance, you get the same cover as you would with our Comprehensive insurance. If not, you still have the same cover, except you also pay the Outside Odometer excess ($1000). This is in addition to any other excesses which apply to the claim. In some cases, no excess is payable.

At each renewal, we increase your End Odometer reading by the number of kilometres you told us you planned to drive each year. You can also ask us adjust your End Odometer reading at any time. However, your end odometer reading cannot be more than 15,000km higher than:

- your Start Odometer reading (for new policies) or

- your End Odometer reading immediately before your last renewal (for renewed policies).

To increase your End Odometer reading give us a call on 13 19 48. See our PDS for more details.

Do I qualify for Pay As You Drive cover?

If you are not driving frequently you could qualify for our Pay as You Drive cover and save money on your car insurance. If you are eligible for our Pay As You Drive cover when obtaining a quote, you will be offered that option.

How do I get Pay As You Drive car insurance?

It’s easy to sign up for Pay as You Drive car insurance. Simply get a quick car insurance quote online to check if you qualify, and discover how much you could save. If you qualify, simply accept the quote, provide your car’s odometer reading when you sign up for your policy, and the Pay as You Drive option will be shown on your Certificate of Insurance.

For more information, check the Real Car Insurance Product Disclosure Statement.

What is the starting odometer reading?

Your car’s odometer reading you provide when you first take out the Pay As You Drive cover. This reading will be shown on your Certificate of Insurance in your first period of insurance.

How can I pay for my car insurance policy?

You can pay by direct debit from a credit card or bank account. We’ll set up an automatic payment schedule for you so you don’t need to do anything when your premium is due – it’s all done for you!

How can I reduce my car insurance premium?

We’d be happy to help! We have a wide range of car insurance products, so you can choose a policy that’s affordable for you. Here are some of the ways you can keep costs down:

- If you want Comprehensive cover but you drive less than your neighbours, check to see if you qualify for Pay As You Drive cover.

- Choose a higher excess. The higher your excess, the lower your premium. But remember, while your premiums will be cheaper now, you will have to pay more if you need to make a claim.

How do I renew my car insurance policy?

One of the great things about having insurance with Real Insurance is our no-fuss automatic renewals. So when you receive your insurance renewal documents, you must read over the details and check that everything is correct. If nothing has changed, then you can just relax while your policy renews automatically. You only need to call us on 13 19 48 if you need to make changes to your policy or details, or you do not wish to renew with us.

What no-claim discount do you offer on car insurance?

At Real Insurance, we believe in giving all our customers real savings and real value right from the start. So instead of promising you a no claim bonus sometime in the future, we give you lower-cost insurance from the day you join.

We work out your premium by considering factors like the type of car you want to insure, your age, other drivers of your car, your location and your insurance history, then give you the best possible deal every time.

To find out how much you could save, get an online car insurance quote today.

Read what our customers are saying

View your car insurance options by state below:

ACT NSW, Queensland, South Australia, Western Australia, Victoria, Tasmania, Northern Territory.

- Applies in the event of a total loss provided you are the first registered owner, or the car was a dealer demonstrator model when you bought it.

- Percentages calculated by comparing night-time parking options selected by Real Car Insurance customers from June 2016 to June 2017.

- Islands and territories are excluded from cover.

- If your battery is flat we arrange for a jump start or coordinate a replacement battery if required. We do not cover the cost of the replacement battery but we can arrange the supply as part of our service.

- The cost of repairs, including labour and any required parts, will be your responsibility.

- If you drive an LPG fuelled vehicle, we will arrange for the towing of your vehicle to the nearest petrol station. The delivery is free, and the maximum value of fuel provided is $10.